Gst on jewellery items new arrivals

Gst on jewellery items new arrivals, Jewellers say 3 GST on gold challenging but will boost the new arrivals

$0 today, followed by 3 monthly payments of $18.33, interest free. Read More

Gst on jewellery items new arrivals

Jewellers say 3 GST on gold challenging but will boost the

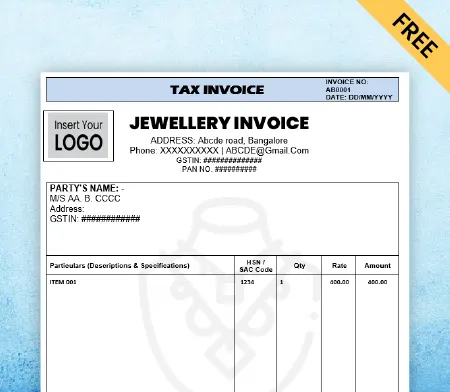

15 Jewellery Bill Book Format Free Download Vyapar App

Jewellery Sales Remain Sluggish On Akshaya Tritiya Consumers

Applicability of GST in case of wastage of gold in Jewellery

Jewellery Shop Billing Software

Applicability of GST on Second Hand Jewellery Legal Window

instalacije-jazbinsek.si

Product Name: Gst on jewellery items new arrivalsGST on Gold Jewellery Art of Gold Jewellery Coimbatore new arrivals, Impact of GST on Gold and Gold Jewellery Prices Razorpay Learn new arrivals, GST Impact Study for Jewellers new arrivals, Budget 2022 23 GJC Assoc. Suggests FM for 1.25 GST from 3 new arrivals, GST Impact On Gold Impact of GST on gold and gold jewellery new arrivals, GOM Accepts 3 GST Rate on Sale of Old Gold Jewellery SAG Infotech new arrivals, GST on Gold Effects of Gold GST Rate in India 2023 new arrivals, GST of Jewelers and Goldsmith Compilation of FAQs new arrivals, GST On Gold In 2022 Check Tax Rates HSN Codes Here new arrivals, Understanding GST on Jewellery Regulations Compliance and new arrivals, GST rates GST impact on gold jewellery Larger players to emerge new arrivals, Gold Jewellery HSN Code GST Rates for Gold IndiaFilings new arrivals, GST on Gold Impact on Imports Jewellery and other Sectors new arrivals, Impact of GST on Gold and Gold Jewellery Prices Razorpay Learn new arrivals, GST rate on jewellery making charges cut to 5 from 18 stocks new arrivals, Offline JEE Shop Jewellery GST Billing And Accounting Software new arrivals, Gold Higher GST on gold jewellery may make rural customers prefer new arrivals, GST on Gold Jewellery Goyal Mangal Company new arrivals, GST rate on gems and jewellery should be 1.25 says industry body new arrivals, Ujjain Printers Jewellers Bill book GST Facebook new arrivals, Jewellery sales rise 50 on freebies ahead of GST roll out new arrivals, GST on Gold Effects of Gold GST Rate in India 2024 new arrivals, GST on Gems Jewelry A Detailed Analysis new arrivals, Jewellers seek removal of GST on exhibition items A2Z Taxcorp LLP new arrivals, GST on Gold Jewellery Making Charges 2022 Bizindigo new arrivals, How Much GST is Applied to Gold Jewellery in India The Caratlane new arrivals, on behalf of the secretary of the Jewellers Association Panipat new arrivals, GST headwinds for gold jewellery sector but high price may impact new arrivals, GST On diamond jewellery In 2022 Check Tax Rates HSN Codes Here new arrivals, No 3 GST when individuals sell gold jewellery to registered new arrivals, GST ON GEMS AND JEWELLERY BUSINESS FAQs GST ON MAKING CHARGES IN CASE OF JEWELLERY CA CHETAN new arrivals, Jewellers say 3 GST on gold challenging but will boost the new arrivals, 15 Jewellery Bill Book Format Free Download Vyapar App new arrivals, Jewellery Sales Remain Sluggish On Akshaya Tritiya Consumers new arrivals, Applicability of GST in case of wastage of gold in Jewellery new arrivals, Jewellery Shop Billing Software new arrivals, Applicability of GST on Second Hand Jewellery Legal Window new arrivals, Impact of GST on Gold Jewellery A Guide new arrivals, GST to be paid only on difference between Selling Price and new arrivals, Grab this Limited time No GST offer Maduras Jewellery Facebook new arrivals, GST Impact on Gold Gold Jewelry new arrivals, GST Valuation purchase of used second hand gold jewellery or new arrivals, How Much GST is Applied to Gold Jewellery in India The Caratlane new arrivals, Gst On Jewellery Stock Photos and Pictures 15 Images Shutterstock new arrivals, GST on Gold coins making charges HSN code GST PORTAL INDIA new arrivals, GST Council may do away with 5 rate move items to 3 8 slabs new arrivals, GST on Gold Jewellery Everything you Need to Know new arrivals, Effects of GST on Gold Jewellery Bajaj Finance new arrivals, Jewellery industry urges government to reduce GST to 1.25 Times new arrivals, 9 best accounting software for Ecommerce companies new arrivals.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Gst on jewellery items new arrivals

- gst on jewellery items

- gst on hallmark gold

- gst on jewellery making charges

- gst on making charges

- gst on making charges of gold

- gst on making charges for gold jewellery

- gst on making charges of gold jewellery

- gst on old gold exchange

- gst on purchase of gold

- gst on pure gold